There's a better way to bank and it starts without a bank.

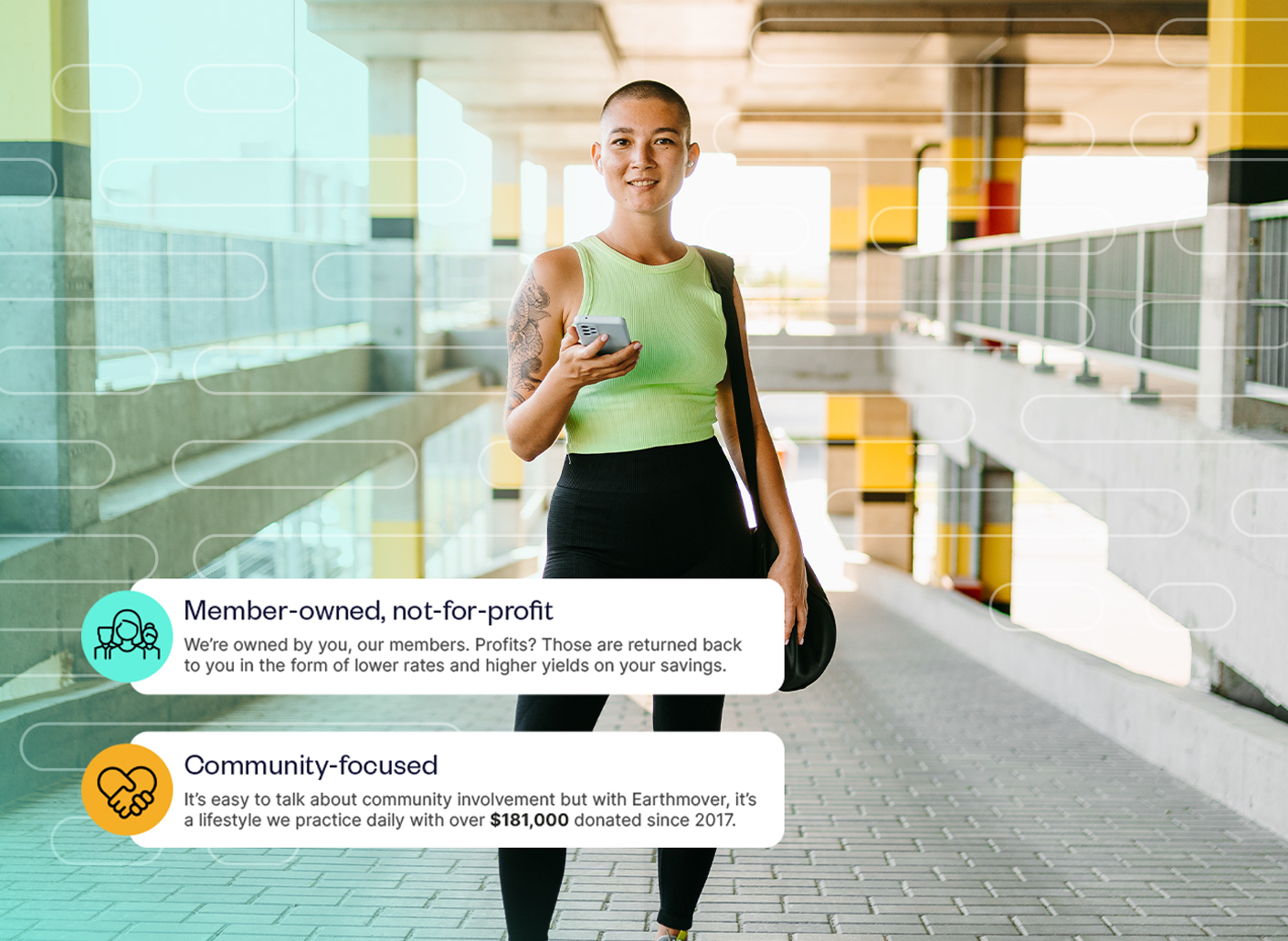

Our members aren't just account numbers. They're part-owners with a voice in how we operate. Here, you're more than just a customer—you're a valued member of a community that's committed to your financial well-being.

Go from where you were, to where you’re going.

When you join Earthmover, you're part of a community of nearly 30,000 members—all part-owners of the credit union. Because we're a not-for-profit, we're accountable to one another rather than to shareholders, often offering better interest rates and perks that make being an Earthmover a joy at every step.

- Fewer and lower fees

- Lower loan rates

- Higher savings yields

- More member perks

Your membership does more.

- Six conveniently located, full-service branches

- A full suite of checking and savings products

- Low rates for borrowing and high rates for savings

- Easy access to Earthmover Financial Partners

- Discounts at hundreds of retailers and restaurants

Are you ready to take the next step? The member application process only takes a few minutes and the benefits last a lifetime.

For every ambition, a way forward.

Have your cake and share it, too.

Share the benefit of being an Earthmover with friends or family and when they become a member, we'll deposit $58 into your account², $58 into theirs and donate $58 to a local organization of your choice². It's a simple way of celebrating our roots in this wonderful community, while rewarding you and your friends at the same time. Just another way it pays to be an Earthmover.

Bank happy.

Escape the bank drama by escaping banks all together. You want to be somewhere people care about your next step—because every step matters. For over 60 years, Earthmover Credit Union has helped changed lives in our community by providing personalized, local service from experts who want to see you succeed. We’re incredibly proud of where we’ve been, and how we can help you get to where you want to go.

¹ No payments will be required for the first 90 days. Only applies to auto loans. Interest will accrue during this period.

² To qualify for the referral bonus, the member making the referral must use the online referral form. The referred person must open a membership with Earthmover Credit Union with a share savings account and open at least one additional account within 30 days of the referral date. The referred new member's accounts must remain open for at least 365 days. Bonuses will be awarded via deposit to share savings accounts up to 45-60 days after all criteria have been met and verified. In the event more than one member refers the same individual, Earthmover Credit Union will award the bonus to the first member making the referral. Referred member must be new to Earthmover Credit Union. There is no limit to the number of referrals a member may submit. You must qualify for and establish membership at Earthmover Credit Union and be of legal contract age to apply. All accounts are subject to our normal approval process. Members and accounts must be in good standing and accounts must have recent account activity such as debit transactions, credit card transactions, direct deposit, etc. to receive bonuses. Earthmover Credit Union rules and regulations apply. Members who have closed the Earthmover Credit Union membership within three months prior to being referred are not eligible. Fees can reduce earnings on the account. This offer is non-transferable and may be canceled without prior notice. We reserve the right to disqualify any referrals in circumstances where we reasonably believe they were not sent to us in good faith. Local non-profit donation will be paid once all criteria has been met and verified. Earthmover Credit Union reserves the right to terminate the program at any time, revise program terms or refuse bonuses upon our discretion. Ask us for details. Cash incentive will be reported on IRS form 1099-INT.